What Happened in the Oahu Real Estate Market in January 2024?

“The Oahu real estate market continues to improve, ending January 2024 with increases in both sales and prices for homes and condos,” said Chief Operating Officer for Locations Chad Takesue. “As mortgage rates ease, we expect to see many buyers and sellers who pulled out of the market last year test the waters again. Buyers will also have more listings to choose from, compared to a year ago.”

For-sale inventory—though still near historic lows—has risen 10% over the past year, a positive sign for the health of the market. However, with Months of Remaining Inventory hovering around three to 3.5 months, Oahu remains a sellers market. A low supply of homes for sale, particularly entry-level homes, coupled with strong demand from local and offshore buyers, results in continued competitive market conditions.

Takesue acknowledged that while borrowing costs are trending down, affordability remains an issue for many buyers. There are few single-family homes for sale that would be affordable for a median-income family with typical financing. Most of these homes can be found in Leeward Oahu, from Waianae to Makaha. However, lower-priced homes can also be found in Kapalama, in Urban Honolulu, and near Hauula, on the upper Windward coast. More than half of for-sale condo inventory is affordable to a family at the median income level. Market areas with higher percentages of lower-priced condos include Mililani, Pearl City-Aiea and Leeward Oahu, as well as many in-town markets, including Salt Lake, Downtown, Makiki, and Kapiolani-University.

Key Takeaways from the January 2024 Locations Oahu Real Estate Report

New to real estate market data terms? See our glossary.

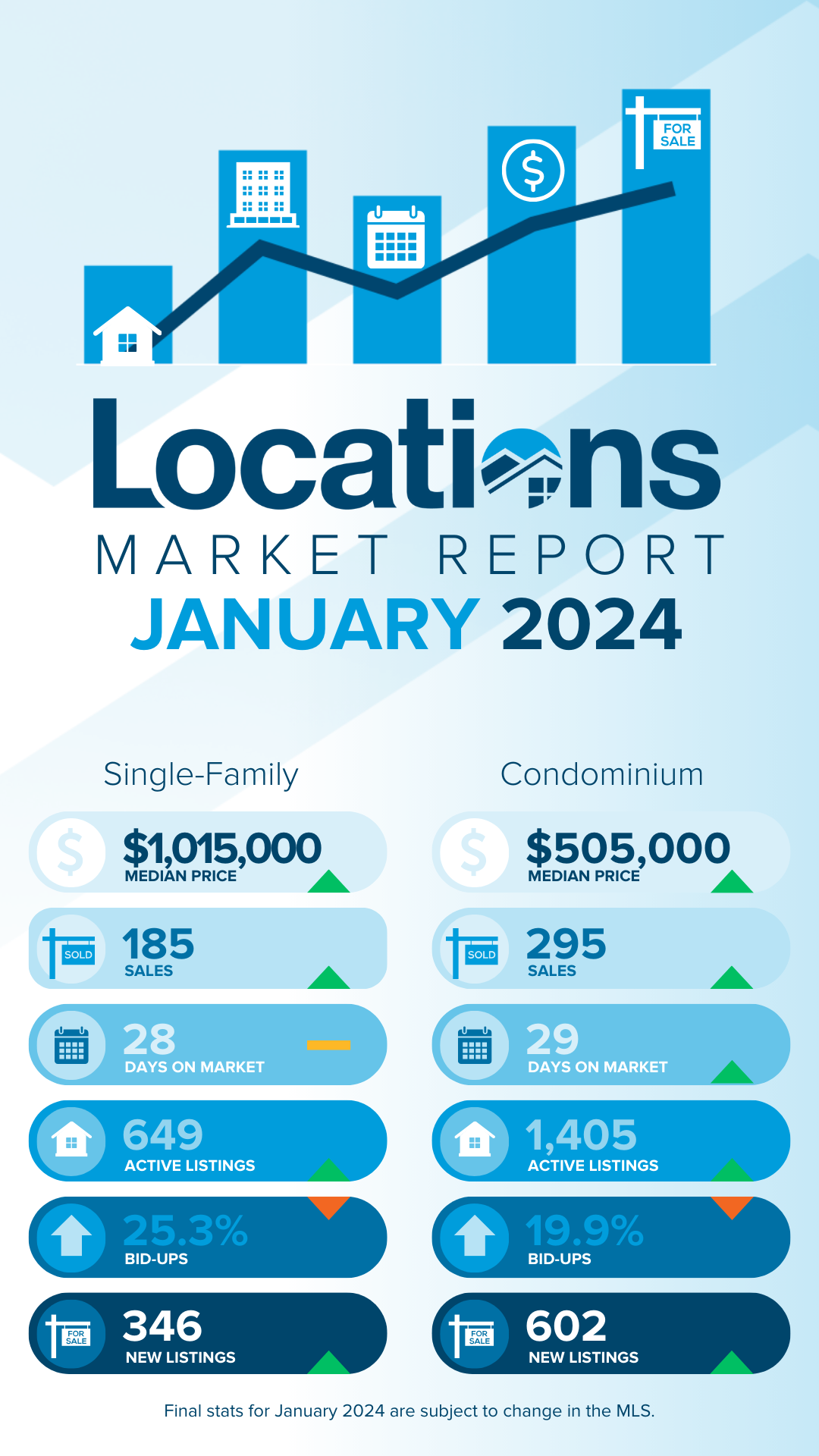

- The January median single-family home price of $1,015,000 is four percent higher than a year ago, and the median condo price of $505,000 is three percent higher. Flat to slightly rising price trends are expected to continue in 2024.

- January home sales rose 23 percent from the previous year, while condo sales increased by six percent. Sales trends are settling into typical seasonal patterns, suggesting moderate growth in 2024.

- At the end of January 2024, 649 homes and 1,405 condos were available for sale—an increase of nine percent and 11 percent, respectively. Although inventory rose slightly in the last half of 2023, it is still near historic lows.

- There were three Months of Remaining Inventory (MRI) for single-family homes and 3.6 MRI for condos at the end of January 2024. This measure is relatively flat and still firmly in sellers’ market territory, underscoring low supply and strong demand in the Oahu market.

- Median Days on Market (DOM) in January was 28 days for homes and 29 days for condos—roughly the same as a year ago. DOM is set to fall in the coming months, following typical seasonal trends. Steady buyer demand continues to keep market times low.

- Competitive market pressures also continue, with 25.3 percent of homes and 19.9 percent of condos sold in January bid up over the asking price.

What Happened in Oahu Single-Family Home Markets in January 2024?

Market statistics can vary greatly by neighborhood, so it's important to consult a knowledgeable Realtor who has access to market-level data.

Here's a detailed breakdown of key Oahu single-family home market areas. The statistics are for the 12-month period ending January 2024:

West Honolulu Homes

West Honolulu's single-family home market experienced a 28% decline in sales as of January 2024, with 122 transactions, and a 6% decrease in the median home price, settling at $985,000. Days on Market (DOM) increased by 23% and the bid-up percentage dropped by 34%, providing potential buyers with slightly more favorable conditions.

Nuuanu-Makiki Homes

As of January 2024, Nuuanu-Makiki's single-family home market saw a 17% decline in sales, with 100 transactions, accompanied by an 11% decrease in the median home price, settling at $1,147,250. Days on Market (DOM) increased by 20% and the bid-up percentage dropped by 24%, potentially offering a more balanced environment for both buyers and sellers.

Manoa Homes

The Manoa single-family home market saw a 33% decrease in sales, with 64 transactions, and a 6% decline in the median home price, settling at $1,505,000 as of January 2024. The Manoa homes market also exhibited a 19% increase in Days on Market (DOM), a 31% reduction in bid-up percentage and a significant 142% surge in Months Remaining Inventory (MRI), suggesting a more favorable environment for potential buyers.

Kaimuki Homes

As of January 2024, the Kaimuki single-family home market experienced a 25% decrease in sales, totaling 118 transactions, and an 8% decline in the median home price, settling at $1,200,000. Market dynamics reflected a 4% increase in Days on Market (DOM), a 15% decrease in bid-up percentage, and a 51% rise in Months Remaining Inventory (MRI), suggesting slightly more favorable conditions for buyers in Kaimuki during this period.

Waialae-Kahala Homes

Waialae-Kahala's single-family home market saw a 19% drop in sales, totaling 72 transactions, and a 3% decrease in the median home price at $2,375,000 as of January 2024. Days on Market (DOM) increased by 94%, while bid-ups fell by 46% and Months Remaining Inventory (MRI) rose by 38%, suggesting a slower-paced market with slightly increased housing supply.

East Oahu Homes

As of January 2024, the East Oahu single-family home market experienced a 30% decrease in sales, with 62 transactions, and a 10% decline in the median home price, settling at $1,647,500. The East Oahu homes market also saw a 7% increase in Days on Market (DOM), a 10% rise in bid-up percentage and a 26% increase in Months Remaining Inventory (MRI).

Hawaii Kai Homes

Hawaii Kai's single-family home market witnessed a 14% decline in sales as of January 2024, totaling 137 transactions, along with a 6% decrease in the median home price, settling at $1,540,800. Other market indicators show a 55% increase in Days on Market (DOM), a 47% decrease in bid-up percentage and a 59% rise in Months Remaining Inventory (MRI). These changes indicate a potentially more balanced environment in Hawaii Kai during this period.

Kailua Homes

The Kailua single-family home market experienced a 17% decrease in sales, totaling 239 transactions, alongside a 3% increase in the median home price, settling at $1,644,000 as of January 2024. Days on Market (DOM) increased by 23%, while bid-ups decreased by 31% and Months Remaining Inventory (MRI) rose by 34%, suggesting slightly more favorable conditions for buyers in Kailua.

Kaneohe Homes

As of January 2024, the Kaneohe single-family home market saw a 20% decrease in sales, totaling 173 transactions, with a marginal 1% decline in the median home price, settling at $1,200,000. Other market indicators included a 17% increase in Days on Market (DOM), a 33% decrease in bid-up percentage and a 5% rise in Months Remaining Inventory (MRI).

North Shore Homes

Sales of North Shore single-family homes declined by 35%, totaling 61 transactions, with an 8% decrease in the median home price, settling at $1,602,750 as of January 2024. Days on Market (DOM) increased by 29%, while the bid-up percentage decreased by 14% and Months Remaining Inventory (MRI) surged by 103%, pointing to a slower-paced market with increased housing supply relative to demand.

Leeward Homes

As of January 2024, the Leeward single-family home market experienced an 8% decrease in sales, totaling 248 transactions, and a 4% decline in the median home price, settling at $677,000. Market dynamics reflected a 119% increase in Days on Market (DOM), a 47% decrease in bid-up percentage and a 24% rise in Months Remaining Inventory (MRI), suggesting a slower-paced market with slightly increased housing supply.

Ewa Homes

Sales of Ewa single-family homes declined by 24% as of January 2024, totaling 484 transactions, with a 3% decrease in the median home price, settling at $889,500. The market also saw a 150% increase in Days on Market (DOM), a 41% decrease in bid-up percentage, and a 58% rise in Months Remaining Inventory (MRI).

Makakilo Homes

As of January 2024, the Makakilo single-family home market witnessed a 31% decline in sales, totaling 90 transactions, and a 4% increase in the median home price, settling at $1,025,000. Days on Market (DOM) increased by 104%, while bid-ups decreased by 47% and Months Remaining Inventory (MRI) rose by 38%.

Waipahu Homes

Waipahu single-family home sales declined by 25% as of January 2024, totaling 156 transactions, with a 4% decrease in the median home price, settling at $921,500. Days on Market (DOM) increased by 92%, while bid-ups decreased by 43% and Months Remaining Inventory (MRI) dropped by 25%.

Mililani Homes

As of January 2024, the Mililani single-family home market observed a 23% decline in sales, totaling 137 transactions, accompanied by a 4% decrease in the median home price, settling at $1,060,000. The Mililani homes market also saw a 55% increase in Days on Market (DOM), a 39% decrease in bid-up percentage and an 18% decline in Months Remaining Inventory (MRI).

Pearl City-Aiea Homes

The Pearl City-Aiea single-family home market experienced a 14% decline in sales, totaling 191 transactions, along with a 4% decrease in the median home price, settling at $985,000 in January 2024. The Pearl City-Aiea homes market also saw a 42% increase in Days on Market (DOM), a 36% decrease in bid-up percentage and a 22% rise in Months Remaining Inventory (MRI), suggesting a slower-paced market.

What Happened in Oahu Condo Markets in January 2024?

Here's a detailed breakdown of key Oahu condo market areas. The statistics are for the 12-month period ending January 2024:

Salt Lake Condos

In January 2024, the Salt Lake condominium market experienced a 32% decline in sales, totaling 158 transactions, and a marginal 1% decrease in the median condo price, settling at $440,000. Market dynamics showed a 7% increase in Days on Market (DOM), a 33% decrease in bid-up percentage and a 156% surge in Months Remaining Inventory (MRI), suggesting a slower-paced market with increased inventory relative to demand.

Downtown-Nuuanu Condos

Sales of the Downtown-Nuuanu condominium market decreased by 27% as of January 2024, totaling 265 transactions, with a stable median condo price at $410,000. Days on Market (DOM) increased by 67%, bid-up percentage decreased by 59% and Months Remaining Inventory (MRI) rose by 35%, hinting at a potential shift towards a more balanced environment for condominiums in Downtown-Nuuanu during this period.

Ala Moana-Kakaako Condos

The Ala Moana-Kakaako condominium market experienced a 23% decrease in sales, totaling 669 transactions, with a 3% decline in the median condo price at $745,000 as of January 2024. Other market indicators showed a 33% increase in Days on Market (DOM), a 31% decrease in bid-up percentage and a 37% rise in Months Remaining Inventory (MRI).

Makiki Condos

As of January 2024, the Makiki condominium market saw a significant 28% decline in sales, totaling 279 transactions, despite a 2% increase in the median condo price, reaching $395,000. Days on Market (DOM) increased by 33%, bid-ups decreased by 40% and Months Remaining Inventory (MRI) surged by 106%, suggesting a potential shift towards a more balanced market.

Waikiki Condos

Sales of Waikiki condominiums decreased by 13% as of January 2024, totaling 1,089 transactions, with a 1% increase in the median condo price at $430,000. Other market dynamics showed a 40% increase in Days on Market (DOM), a 35% decrease in bid-up percentage and a 16% rise in Months Remaining Inventory (MRI), suggesting a market with a slower pace and slightly increased housing supply relative to demand.

Kapiolani-University Condos

As of January 2024, the Kapiolani-University condominium market observed a 34% decline in sales, totaling 227 transactions, accompanied by a 2% decrease in the median condo price, settling at $415,000. Market indicators revealed a 6% increase in Days on Market (DOM), a 34% decrease in bid-up percentage and a 164% surge in Months Remaining Inventory (MRI), suggesting a more buyer-friendly environment during this period.

Diamond Head-Kahala Condos

The Diamond Head-Kahala condominium market experienced a 30% decrease in sales as of January 2024, totaling 92 transactions, with an 8% increase in the median condo price, reaching $677,500. Other market indicators include a 19% decrease in Days on Market (DOM), a 37% decrease in bid-up percentage and a 63% rise in Months Remaining Inventory (MRI).

Hawaii Kai Condos

In January 2024, the Hawaii Kai condominium market experienced a 21% decrease in sales, totaling 143 transactions, despite a 2% increase in the median condo price, reaching $849,000. Days on Market (DOM) increased by 68%, while bid-ups fell by 48% and Months Remaining Inventory (MRI) declined by 29%, suggesting a potential shift towards a more balanced environment for condominiums in Hawaii Kai during this period.

Kailua Condos

Kailua condominium sales decreased by a marginal 1%, totaling 98 transactions, with a 1% increase in the median condo price, reaching $761,500. Market dynamics included a 25% increase in Days on Market (DOM), a 45% reduction in bid-up percentage and a 24% rise in Months Remaining Inventory (MRI), suggesting a slightly less competitive market as of January 2024.

Kaneohe Condos

As of January 2024, the Kaneohe condominium market experienced a 32% decrease in sales, totaling 136 transactions, with a 4% decrease in the median condo price, settling at $680,000. The Kaneohe condo market also saw a 27% increase in Days on Market (DOM), a 40% decrease in bid-up percentage and a 67% rise in Months Remaining Inventory (MRI), hinting at a slightly less competitive market last month.

Leeward Condos

The Leeward condominium market witnessed a 34% decrease in sales in January 2024, totaling 150 transactions, with a marginal 1% increase in the median condo price, reaching $252,500. Other market indicators showed a 154% increase in Days on Market (DOM), a 24% decrease in bid-up percentage and a significant 136% rise in Months Remaining Inventory (MRI), suggesting a potential shift towards a more balanced environment for Leeward condominiums.

Ewa Condos

In January 2024, the Ewa condominium market saw a 33% decrease in sales, totaling 378 transactions, with a marginal 1% decrease in the median condo price, settling at $680,000. Market dynamics revealed a 70% increase in Days on Market (DOM), a 44% decrease in bid-up percentage and a 53% rise in Months Remaining Inventory (MRI).

Makakilo Condos

Makakilo condominium sales decreased by 31% as of January 2024, totaling 105 transactions, with a marginal 1% decrease in the median condo price, settling at $550,000. Days on Market (DOM) increased by 91%, the bid-up percentage decreased by 34% and Months Remaining Inventory (MRI) rose by 14%, suggesting a slower-paced condo market in Makakilo during this period.

Waipahu Condos

As of January 2024, the Waipahu condominium market experienced a 20% decrease in sales, totaling 155 transactions, with a 3% decrease in the median condo price, settling at $500,000. Market dynamics included a 64% increase in Days on Market (DOM), a 35% decrease in bid-up percentage and a 2% rise in Months Remaining Inventory (MRI).

Mililani Condos

The Mililani condominium market saw a 20% decrease in sales as of January 2024, totaling 292 transactions, with a 4% decrease in the median condo price, settling at $511,983. Other market indicators showed a 50% increase in Days on Market (DOM), a 28% decrease in bid-up percentage and a 73% rise in Months Remaining Inventory (MRI), indicating a potential shift towards a slightly more balanced market.

Pearl City-Aiea Condos

As of January 2024, the Pearl City-Aiea condominium market observed a 33% decrease in sales, totaling 246 transactions, with a 3% decrease in the median condo price, settling at $460,000. The Pearl City-Aiea condo market also saw a 60% increase in Days on Market (DOM), a 26% decrease in bid-up percentage and a 102% surge in Months Remaining Inventory (MRI).

Summary

Because real estate market conditions can vary greatly among Oahu market areas, it's important for buyers and sellers to partner with a Realtor who has access to detailed, neighborhood-level data.

Glossary

- Active Listings: Count of MLS listings with "Active" status on the last day of the period.

- Bid-Up %: The percent of sales that were bid-up over asking price in competitive offers.

- Days on Market (DOM): Median number of days between listing date and escrow date, for all properties sold in the period.

- Months of Remaining Inventory (MRI): The number of months it would take to sell out the current active inventory at the recent rate of sales. A balance point between supply and demand is considered to be around 6 months, so MRI below 6 months indicates more of a sellers market and MRI above 6 months indicates more of a buyers market.

Congratulations, you have access to Hawaii's most comprehensive Real Estate Search! Please help us to better serve you by answering these optional questions.

Facebook Registration

This email is already registered. Click the button below and we'll send you a link to reset your password.

You have already registered using your FB account.

Check your inbox for an email from brokersmls@locationshawaii.com. It contains a link to reset your password.

The agent who gave you access to this website is no longer with Locations LLC.

Due to local MLS regulations, you will need to re-register if you would like to continue your access.

We will pre-fill the registration form with information in our files. Once you click Register you can either select a new agent or one will be assigned for you.

Sorry for the inconvenience, Locations LLC.

Schedule a Virtual Tour

Request an appointment to view this property by completing the information below. Please note your appointment is not confirmed until an agent calls you.

Disclaimer: The properties we may show you may be Locations LLC listings or listings of other brokerage firms. Professional protocol requires agent to set up an appointment with the listings agent to show a property. Locations, LLC may only show properties marked "Active" and "ACS".

Listings in

Additional Criteria

Keep your eye on this property! Save this listing and receive e-mail updates if the status of the property changes.

Share this property by completing the the form below. Your friend will receive an e-mail from you with a link to view the details of this property.

How can we help?

Send a message and we'll respond shortly.

We will not rent, share, or sell your information. Privacy Policy.