2017 was another strong year for Oahu's real estate market. For the fifth year in a row, median prices rose for both single-family homes and condos. Sales were also higher than expected—up 7 percent for both single-family and condos.

With prices on the rise in almost every neighborhood across the island, we've heard some would-be homeowners wonder aloud if the Oahu real estate market is heading toward a bubble.

In short, the answer is no.

Below, we break down why we're not cruising towards a peak but rather plugging along in the "new normal."

1) This time, it's different

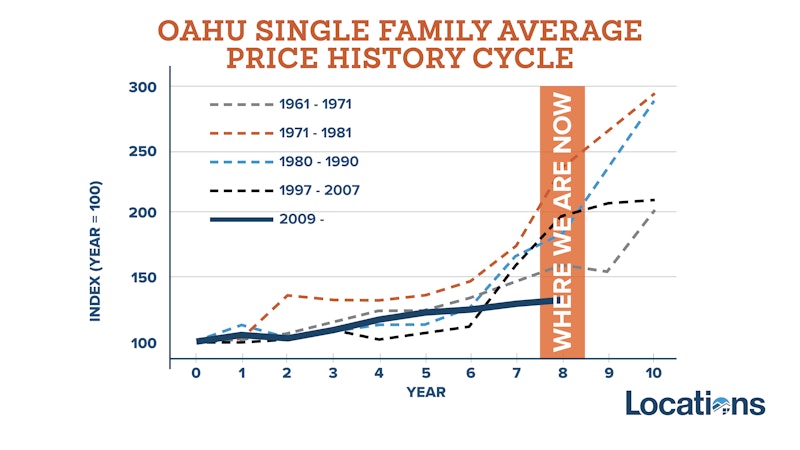

Compared to Oahu's previous four real estate cycles (measured in 10-year periods), the current cycle is behaving quite differently. Past cycles have been marked by five to seven years of lower sales and flat prices followed by three to five years of sharply increasing sales and a strong upswing in median price--often with double-digit percent appreciation. However, the current cycle has seen steadily increasing sales and median prices at a stable rate of about five percent a year.

2) Home prices are not skyrocketing

While it may not feel that way to some who experience sticker shock at Oahu's rising home prices, Locations' historic price values chart (above) shows that prices are actually rising at a very stable, steady rate. Generally speaking, in a housing bubble, median prices increase year over year at a rate that is unsustainable for that market.

3) Rents are rising in line with homeownership

The cost of renting a home on Oahu is basically in line with the cost of owning a home. In previous housing cycles, rapidly rising home prices coupled with flat rents have been a warning sign of a bubble ahead.

4) Housing supply is low and demand is high

In general, a housing cycle has four stages: Recovery, Expansion, Hypersupply and Recession. When the market crosses from Expansion (building more homes) to Hypersupply (too many homes), the warning bells for a bubble begin to sound. For decades, Oahu's housing inventory has been insufficient to meet demand, and despite new construction in West Oahu and Kakaako, supply will likely never catch up to demand, particularly in affordable price ranges--where demand is greatest from local residents. Essentially, Oahu will never experience hypersupply.

Thanks in part to low interest rates, demand is strong among Oahu residents. Fierce competition can be seen in the number of homes bid up over asking price (one in three in 2017) and the number of days a home is on the market before an offer is accepted (18 days in 2017). Of course, the allure of the islands draws buyers from around the world, adding to demand.

5) Interest rates are still favorable

While rates are expected to rise slightly in 2018, they will likely remain around 4-4.5%, which is still historically low. Low interest rates allow more people to become homeowners. When rates rise too quickly, purchasing power falls and fewer people are able to qualify for a loan (which can exacerbate hypersupply in markets that were over-built). Unlike the last housing crisis, however, loan conditions have tightened up--though they are still very reasonable for most future homeowners.

What does this mean for homeowners?

In summary, yes, housing prices on Oahu are high. But high prices alone do not make a bubble. Housing prices and sales will continue to increase as long as supply remains low and demand remains high--and as long as prices are sustainable given employment growth, the overall economy and the interest rate environment.

The bottom line: While the pace of housing price appreciation may slow in the future, it's unlikely that home values will dip as they did a decade ago in many Mainland housing markets.

Congratulations, you have access to Hawaii's most comprehensive Real Estate Search! Please help us to better serve you by answering these optional questions.

Facebook Registration

This email is already registered. Click the button below and we'll send you a link to reset your password.

You have already registered using your FB account.

Check your inbox for an email from brokersmls@locationshawaii.com. It contains a link to reset your password.

The agent who gave you access to this website is no longer with Locations LLC.

Due to local MLS regulations, you will need to re-register if you would like to continue your access.

We will pre-fill the registration form with information in our files. Once you click Register you can either select a new agent or one will be assigned for you.

Sorry for the inconvenience, Locations LLC.

Schedule a Virtual Tour

Request an appointment to view this property by completing the information below. Please note your appointment is not confirmed until an agent calls you.

Disclaimer: The properties we may show you may be Locations LLC listings or listings of other brokerage firms. Professional protocol requires agent to set up an appointment with the listings agent to show a property. Locations, LLC may only show properties marked "Active" and "ACS".

Listings in

Additional Criteria

Keep your eye on this property! Save this listing and receive e-mail updates if the status of the property changes.

Share this property by completing the the form below. Your friend will receive an e-mail from you with a link to view the details of this property.

How can we help?

Send a message and we'll respond shortly.

We will not rent, share, or sell your information. Privacy Policy.