What would you do with an extra $260,000? Move to a larger home, or a new neighborhood? Add an Accessory Dwelling Unit (ADU) to your existing home, or renovate your kitchen and baths?

If you think you don't have that kind of cash on hand, you might be pleasantly surprised: Many Oahu homeowners have a significant amount of home equity—it's almost like your home is a piggy bank that grows bigger each year.

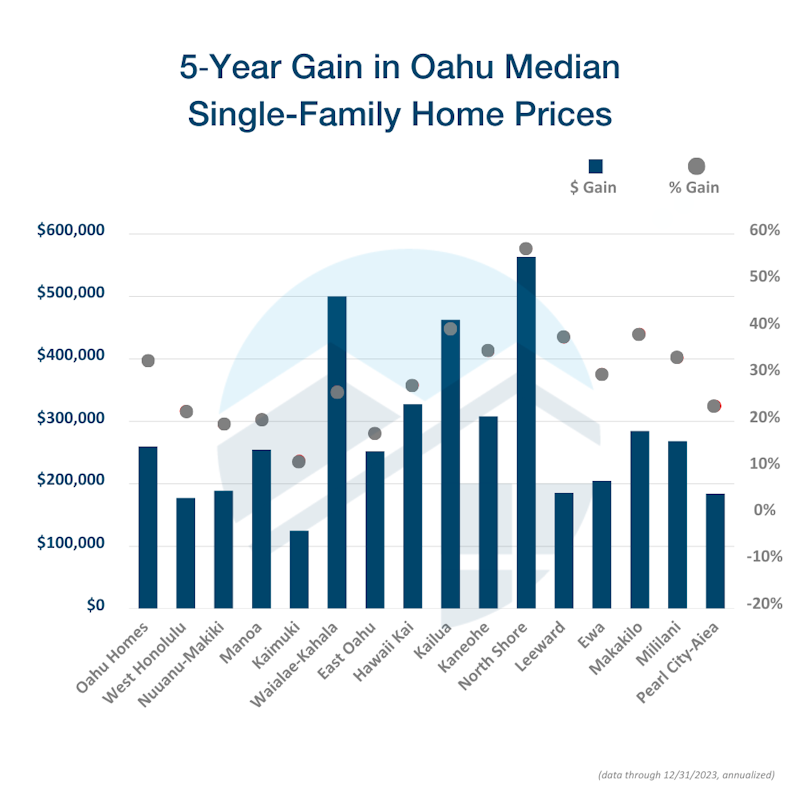

Oahu single-family home prices have jumped by 33 percent over the past five years, which has added an estimated $260,000 to the equity of homeowners. So, if you purchased your home at least a few years ago, it's possible to use your home equity gains to trade up to a new home—in some cases, without adding to your monthly payment. Home equity can also be used to pay off high-interest debts, cover education costs, renovate your existing home or purchase an investment property.

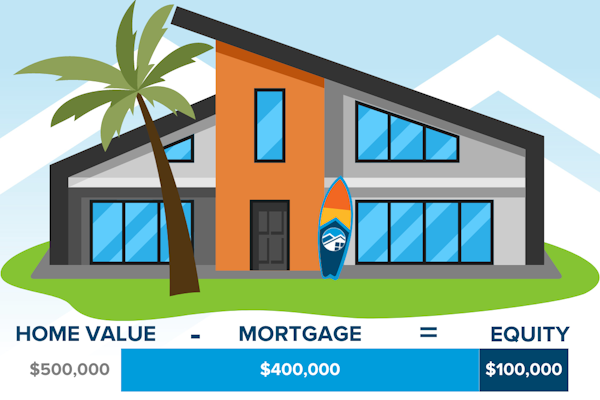

How to calculate home equity

Home equity is the value of your home minus the amount you owe on the home. When you first buy a house, your home equity is the same as your down payment. As you make regular mortgage payments and as your home increases in value, your home equity grows.

To calculate your home equity, you must first have a rough idea of your home's value. You can get a free, instant estimate of your home's value using the Locations Home Valuator tool. For an even more accurate home estimate, contact your real estate agent. Once you know the approximate value of your home, subtract your remaining mortgage balance to find your home equity.

Oahu home values increase over time

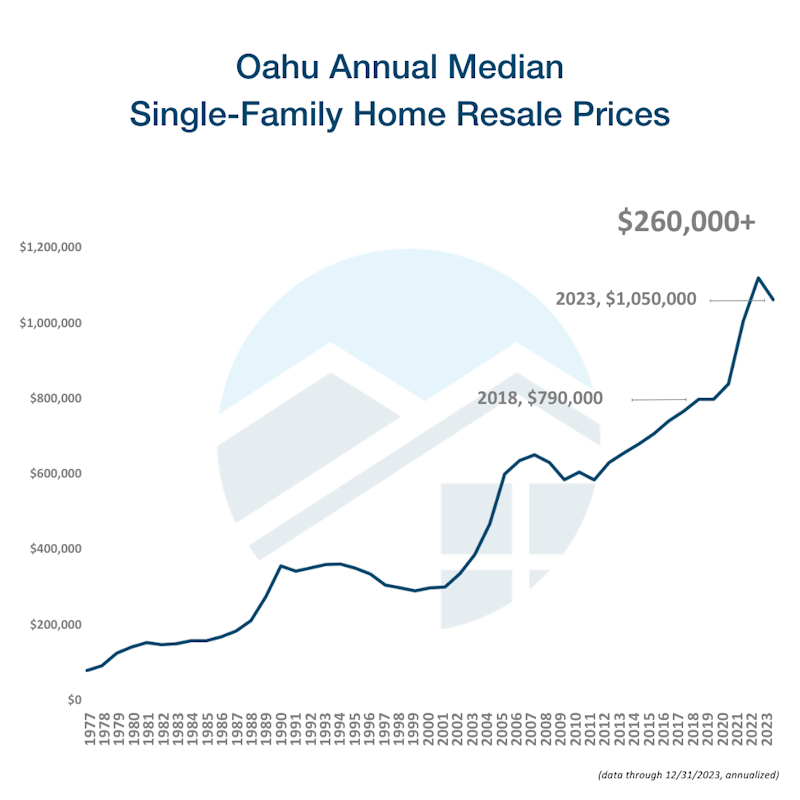

The availability of Oahu homes for sale has been insufficient to meet buyer demand for decades, which has ensured that home values have continued to rise. Historically, Oahu home values have appreciated by five to six percent per year—slightly higher than home values nationwide.

Oahu home values have also weathered recessions better than most other U.S. housing markets. Over the long term, Oahu residential real estate is a solid investment that increases in value over time.

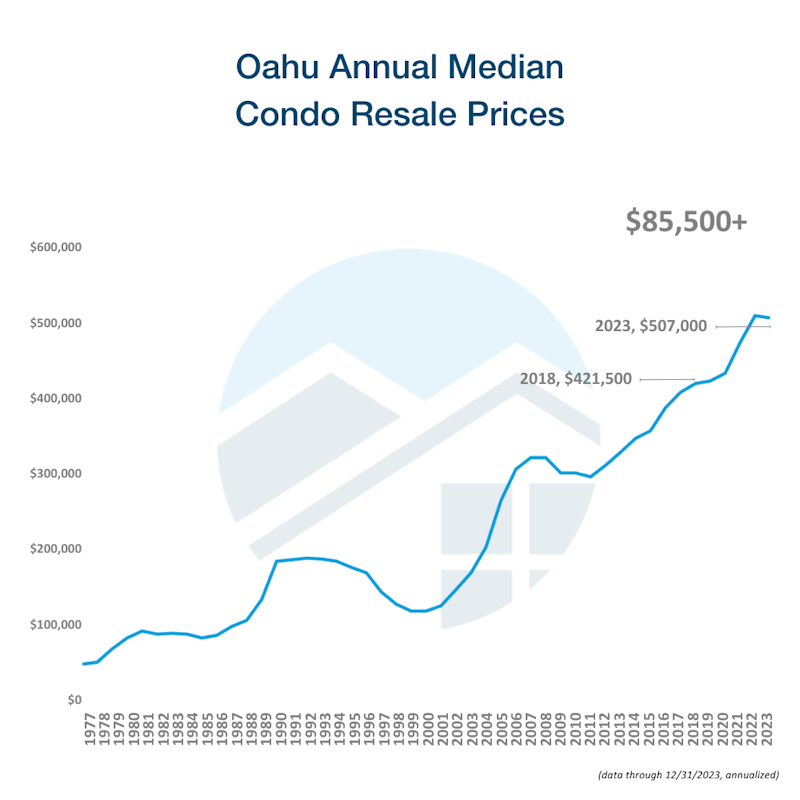

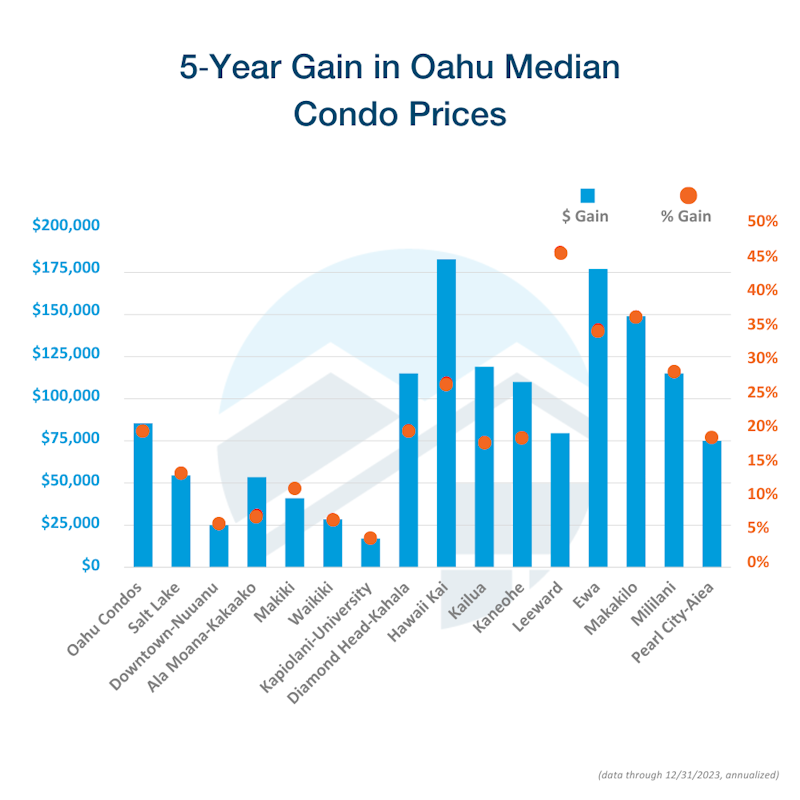

The below charts show how single-family home and condo values have steadily increased since 1977—when Locations began tracking this data—as well as which local real estate market areas have seen the biggest gains in home equity in the past five years.

Homeowners who purchased a home five years ago have an estimated $260,000 in home equity. Those who purchased 10 years ago have an estimated $400,000 in equity.

Homeowners who purchased a condo five years ago have an estimated $85,500 in home equity. Those who purchased 10 years ago have an estimated $175,000 in equity.

While the islandwide median single-family home has appreciated in value by 33 percent over the past five years, gains have varied at the local level. By market area, the largest percentage gain in value for single-family homes at both the 5- and 10-year mark was the North Shore. By dollar amount, the highest-priced market area, Waialae-Kahala, saw the biggest gains, at $500,000 over five years and $835,000 over 10 years.

Since 2018, the islandwide median condo price has appreciated by 20 percent. By market area, the largest percentage gain in value for condos at the 5-year mark was the Leeward market; however, at the 10-year mark, Ewa and Leeward tied at an appreciation of 115 percent. By dollar amount, Hawaii Kai condos had the largest gain over five years at $182,834. However, after 10 years, Ewa condos garnered the highest dollar gain at $363,000.

Contact your real estate agent to discuss your home equity

Reach out to your Locations agent for an accurate picture of your home's current value and your options for putting your home equity to work for you.

Congratulations, you have access to Hawaii's most comprehensive Real Estate Search! Please help us to better serve you by answering these optional questions.

Facebook Registration

This email is already registered. Click the button below and we'll send you a link to reset your password.

You have already registered using your FB account.

Check your inbox for an email from brokersmls@locationshawaii.com. It contains a link to reset your password.

The agent who gave you access to this website is no longer with Locations LLC.

Due to local MLS regulations, you will need to re-register if you would like to continue your access.

We will pre-fill the registration form with information in our files. Once you click Register you can either select a new agent or one will be assigned for you.

Sorry for the inconvenience, Locations LLC.

Schedule a Virtual Tour

Request an appointment to view this property by completing the information below. Please note your appointment is not confirmed until an agent calls you.

Disclaimer: The properties we may show you may be Locations LLC listings or listings of other brokerage firms. Professional protocol requires agent to set up an appointment with the listings agent to show a property. Locations, LLC may only show properties marked "Active" and "ACS".

Listings in

Additional Criteria

Keep your eye on this property! Save this listing and receive e-mail updates if the status of the property changes.

Share this property by completing the the form below. Your friend will receive an e-mail from you with a link to view the details of this property.

How can we help?

Send a message and we'll respond shortly.

We will not rent, share, or sell your information. Privacy Policy.