Calling all future Hawaii homebuyers: This is your week to act!

If you've been on the fence about becoming a homeowner - or trading up to a new home - now is the time to act. Mortgage interest rates, which had been ticking up throughout last year, just saw the biggest drop in a single week in a decade. Today's mortgage interest rate is now lower than it's been in more than a year - giving prospective homebuyers a welcome shot of buying power.

With the lowest borrowing costs in more than a year, coupled with increased inventory in many Oahu neighborhoods and moderated home prices, this is the window of opportunity homebuyers have been waiting for.

After peaking at nearly five percent in November 2018, mortgage interest rates have been trending down in the first quarter of 2019. However, this week's sharp drop in rates - which triggered an increase in mortgage and refinance applications - is noteworthy.

Lower interest rates allow for smaller monthly payments.

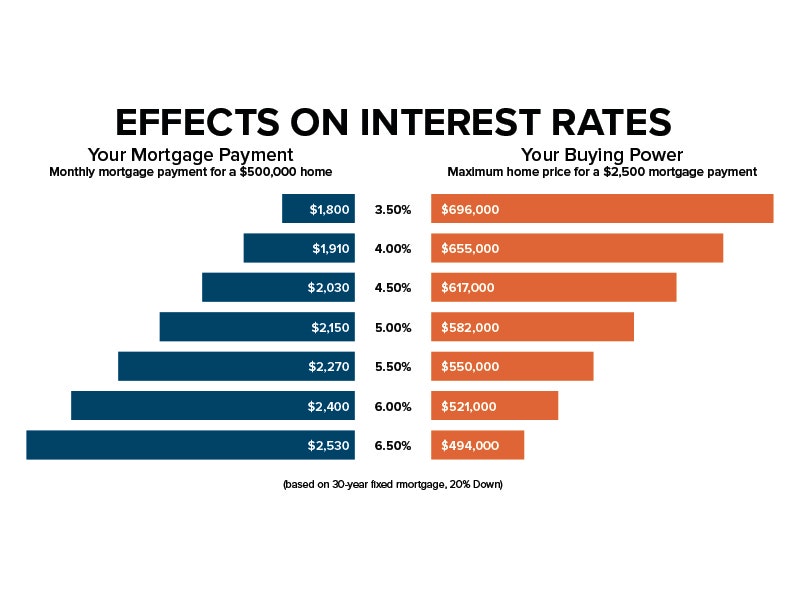

Because interest rates have a direct effect on the monthly mortgage payment, an increase or decrease in rates can make a difference in how much money you can borrow. For example, at an interest rate of 4 percent, the monthly payment on a $500,000 home (with a 20 percent down payment), would be $1,910. On the other hand, should interest rates rise to 5.5 percent, that same $500,000 home would now have a monthly payment of $2,270, or $360 more per month. That's equivalent to a monthly car payment!

Even more good news for homebuyers: The number of Oahu homes for sale priced below $500,000 has increased by nearly 20 percent from one year ago! Lower borrowing costs and more homes from which to choose? Finally!

Lower interest rates mean more home buyers, too.

Lower interest rates isn't just good news for home buyers; it's good news for home sellers, too.

"Lower interest rates may signal increased foot traffic from re-energized home buyers," says Scott Higashi, Locations president and CEO. "If you're a home seller, now is the time - together with your REALTOR® - to ensure that your home is well-positioned in the market to attract the most buyers possible. With today's lower interest rates, you can expect more eyes on your home."

It's uncertain where rates are headed next.

No one knows for sure if mortgage interest rates will hold steady, dip even more, or begin to tick up again. So, if you're ready to purchase your first home, or move up to a new home, now is a good time to act. If you haven't already, you'll want to find a loan officer and get pre-qualified for a home loan. Not sure where to begin? Your Locations REALTOR® can help connect you to a loan officer who can best advise you on your next move.

One thing's for sure; don't try to "time" the market - it may not work in your favor. Over time, investing in a home - particularly in high-value markets like Hawaii - is a solid bet. Lower interest rates, at least for now, make owning a home in Hawaii today an even smarter move.

Congratulations, you have access to Hawaii's most comprehensive Real Estate Search! Please help us to better serve you by answering these optional questions.

Facebook Registration

This email is already registered. Click the button below and we'll send you a link to reset your password.

You have already registered using your FB account.

Check your inbox for an email from brokersmls@locationshawaii.com. It contains a link to reset your password.

The agent who gave you access to this website is no longer with Locations LLC.

Due to local MLS regulations, you will need to re-register if you would like to continue your access.

We will pre-fill the registration form with information in our files. Once you click Register you can either select a new agent or one will be assigned for you.

Sorry for the inconvenience, Locations LLC.

Schedule a Virtual Tour

Request an appointment to view this property by completing the information below. Please note your appointment is not confirmed until an agent calls you.

Disclaimer: The properties we may show you may be Locations LLC listings or listings of other brokerage firms. Professional protocol requires agent to set up an appointment with the listings agent to show a property. Locations, LLC may only show properties marked "Active" and "ACS".

Listings in

Additional Criteria

Keep your eye on this property! Save this listing and receive e-mail updates if the status of the property changes.

Share this property by completing the the form below. Your friend will receive an e-mail from you with a link to view the details of this property.

How can we help?

Send a message and we'll respond shortly.

We will not rent, share, or sell your information. Privacy Policy.