There’s no better time to invest in your own home than as soon as you’re able.

Your downpayment could be as little as three percent

The lending industry has changed dramatically from years ago, when a 20 percent down payment was standard. Yet, more than half of first-time homeowners don't realize that's no longer the case. Today, first-time homeowners can put down as little as three percent, and if you’re in the military or a veteran, you may not need to put down anything at all.

Interest rates are at record lows

More good news for homebuyers: Interest rates are at their lowest point since September 2012. Low interest rates mean more purchasing power for borrowers. Even what seems like a small difference in rates—a few tenths of a percent—can affect your monthly mortgage payments by a few hundred dollars, all of which adds up over the life of the loan.

It's never too early to get on the housing ladder

People delay homeownership for a number of reasons; at the top of the list is the misconception that they can't afford to become homeowners. This is absolutely untrue, and it’s why getting on the housing ladder as soon as you're able to becomes so important.

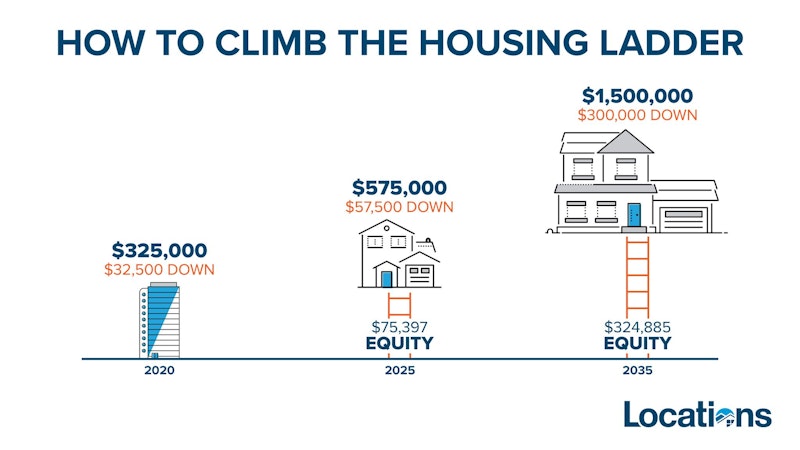

For example, let's say a 20-something Hawaii couple purchases a starter condo in Mililani for $325,000. With a 10 percent downpayment of $32,500, their monthly mortgage payment is actually less than or the same as their current rent. Assuming their condo appreciates by four percent each year—which is on the conservative side for Hawaii, historically speaking—they sell their condo for almost $400,000 five years later, after they’ve had their second child and need more room.

Our couple then uses the equity they gained from their condo to put toward a 10 percent down payment on a three-bedroom townhome in Mililani that costs $575,000. After they have paid sellers’ fees, they will have about $18,000 left over for closing costs and to buy some new furniture for their townhome.

Now, fast forward ten years...the keiki are now teenagers and the family needs a larger home. Assuming a four percent appreciation again and using their equity from the sale of their townhome, our family now has $300,000 after sellers’ fees to put down 20 percent on a $1.5 million-dollar single-family home in Mililani. They will also have about $25,000 left over for closing costs and other expenses. By this time, our couple is middle-aged and has had time to climb their career ladders, too. They are likely MORE financially comfortable now than ever before!

Climbing the housing ladder takes patience

Climbing Hawaii's housing ladder will take some patience, but an investment today means you can eventually get that “forever home” down the road. The most important thing is to get your foot in the door now. Don’t wait until you have 20 percent for a single-family home saved, because for most of us, that could take years. In the meantime, you’re just making your landlord richer while housing prices continue to climb.

Get on to the housing ladder at whatever price point you can. If you’re not sure what you can afford, talk to a knowledgeable Realtor. Locations also offers free, monthly Future Homeowners Seminars that walk you through the process of applying for a loan and finding a home.

Learn more about affordable housing.

Congratulations, you have access to Hawaii's most comprehensive Real Estate Search! Please help us to better serve you by answering these optional questions.

Facebook Registration

This email is already registered. Click the button below and we'll send you a link to reset your password.

You have already registered using your FB account.

Check your inbox for an email from brokersmls@locationshawaii.com. It contains a link to reset your password.

The agent who gave you access to this website is no longer with Locations LLC.

Due to local MLS regulations, you will need to re-register if you would like to continue your access.

We will pre-fill the registration form with information in our files. Once you click Register you can either select a new agent or one will be assigned for you.

Sorry for the inconvenience, Locations LLC.

Schedule a Virtual Tour

Request an appointment to view this property by completing the information below. Please note your appointment is not confirmed until an agent calls you.

Disclaimer: The properties we may show you may be Locations LLC listings or listings of other brokerage firms. Professional protocol requires agent to set up an appointment with the listings agent to show a property. Locations, LLC may only show properties marked "Active" and "ACS".

Listings in

Additional Criteria

Keep your eye on this property! Save this listing and receive e-mail updates if the status of the property changes.

Share this property by completing the the form below. Your friend will receive an e-mail from you with a link to view the details of this property.

How can we help?

Send a message and we'll respond shortly.

We will not rent, share, or sell your information. Privacy Policy.